As the 2024/2025 financial year draws to a close, Kenya’s fiscal indicators are reflecting cautious but notable gains that are redefining the country’s economic trajectory. Driven by the National Treasury's tech-forward and strategic approach, the nation is benefiting from targeted enforcement, disciplined reforms, and a shift to intelligent systems that improve compliance and transparency.

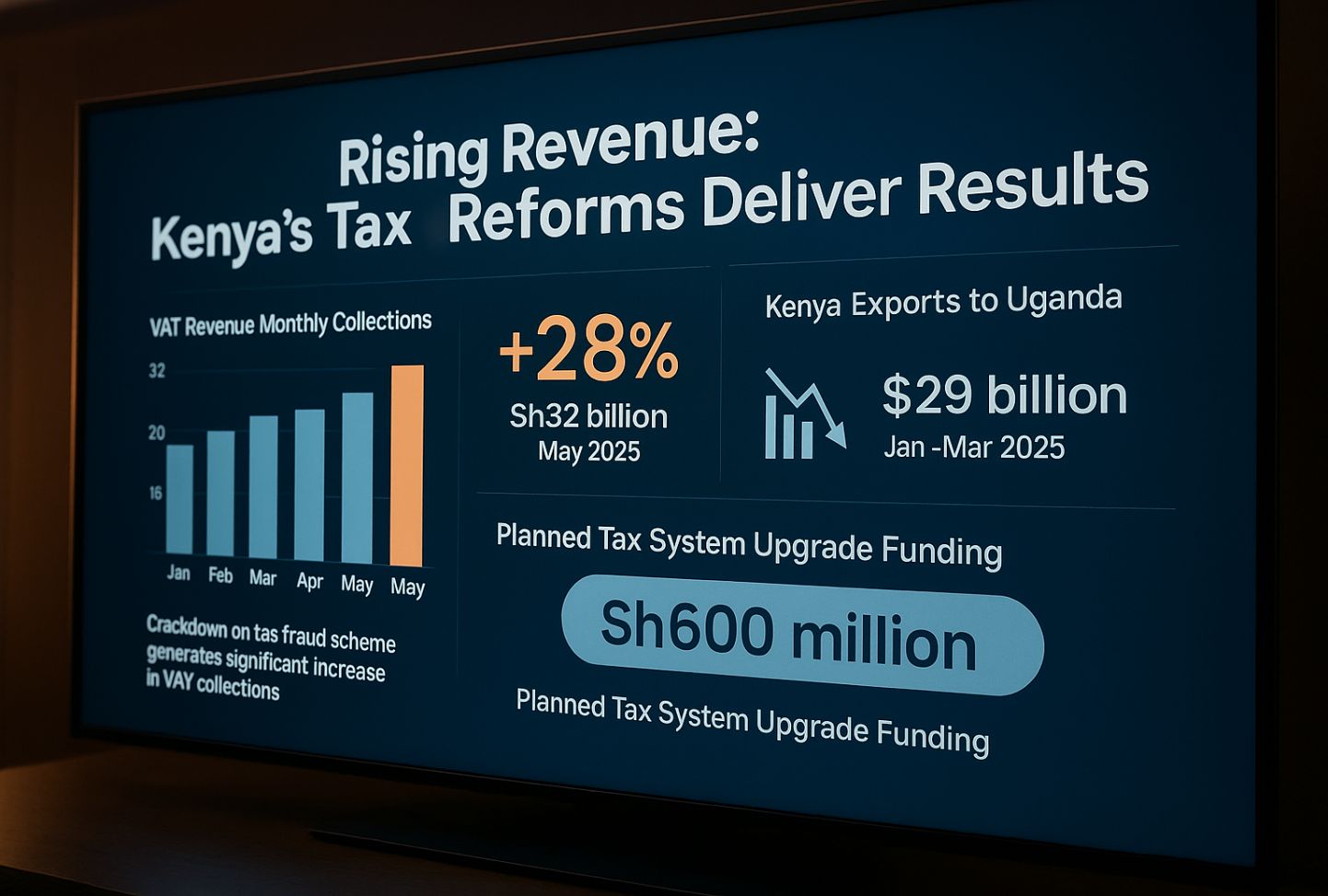

The consistent recovery in domestic Value Added Tax collection is one of the most telling indicators of Kenya's improved fiscal health. Kenya collected Sh32 billion in VAT in May 2025, the most since January of this year and a 28% increase from the previous year.

This performance follows a thorough investigation into a VAT fraud ring that had been embezzling an estimated Sh2.5 billion per month from the national coffers. The Kenya Revenue Authority has restored trust in the VAT system by enforcing stricter regulations and closely monitoring invoicing chains.

VAT collections from January to May 2025 are now more stable and predictable:

January — Sh32 billion

February — Sh29 billion

March — Sh26 billion

April — Sh29 billion

May — Sh32 billion

This consistency signals a return to revenue reliability, a key pillar in reducing fiscal deficits and managing public debt without compromising on service delivery.

The KRA has been allocated Sh600 million to Kenya's 2025/2026 national budget to improve its systems using advanced data analytics and artificial intelligence. It is anticipated that the action will increase compliance, detect tax evasion instantly, and change the revenue authority's enforcement approach from reactive to predictive.

This move to AI-based management is a progressive step toward financial independence. By tying revenue mobilization to contemporary infrastructure, it strengthens domestic resilience and lessens reliance on costly debt. The government aims to enhance the tax system's efficiency to ensure fairness, minimize human error, and expedite collections, particularly in the digital and informal economy, where compliance remains challenging.

However, not every indicator is pointing north. In the first quarter of 2025, Kenya's exports to Uganda, its biggest trading partner, decreased by 0.3% to Sh29 billion. This is the first drop in seven years. Despite growing demand in the Great Lakes region, analysts blame the decline on sporadic border restrictions and ongoing trade tensions that have slowed the flow of goods.

Even though the drop is slight, it emphasizes how urgent it is to harmonize regional policies and invest in infrastructure to facilitate smooth cross-border trade. Recognizing the difficulty, the Treasury has confirmed that reforms in customs and diplomacy are a component of the medium-term plan.

Kenya's resolve to finance its priorities sustainably is demonstrated by the gradual increase in VAT and the impending digitization of tax enforcement. The government has a clear plan: modernize revenue collection methods, close fraud loopholes, and restore public confidence in the tax system.

Despite temporary declines in exports, the overall trend is still upward. With an expanding middle class, better fiscal management, and investments in digital infrastructure, Kenya continues to be the economic hub of East and Central Africa.