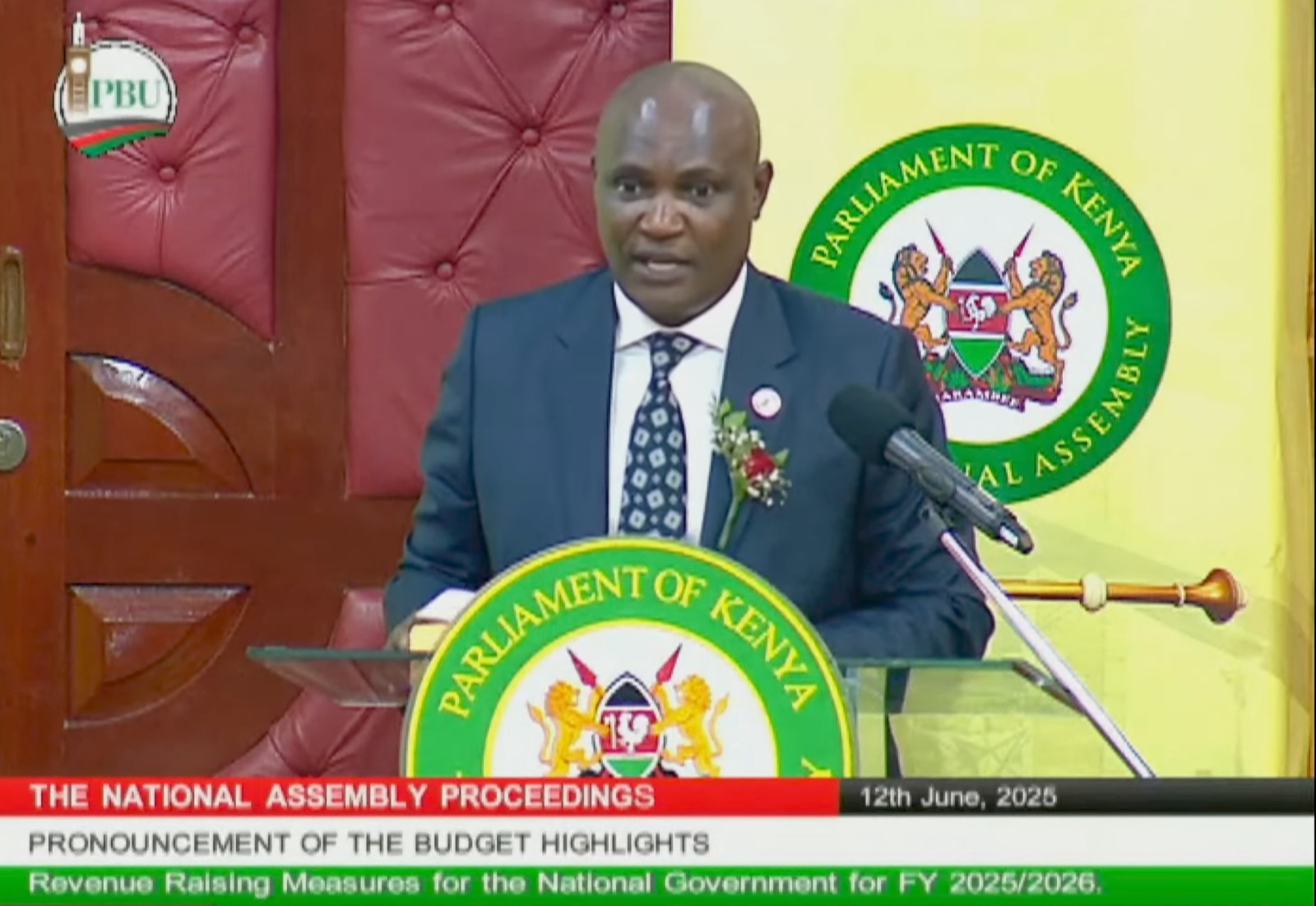

Kenya’s 2025/26 budget, tabled before Parliament this evening by Treasury Cabinet Secretary John Mbadi, marks his first full-year blueprint since assuming office. With a proposed expenditure of Ksh 4.2 trillion, the budget outlines bold policy directions, growth-focused reforms, and a firm commitment to public accountability. CS Mbadi emphasized transparency, debt responsibility, and investment in sectors that directly impact the lives of the majority of Kenyans.

“We are placing citizens at the center of our fiscal decisions, ensuring every coin spent contributes to shared growth and dignity,” CS Mbadi told Parliament during his speech.

This year’s budget is anchored on five goals: economic recovery, job creation, fiscal discipline, affordable services, and social welfare. It allocates:

- Ksh 597 billion for education

- Ksh 146.8 billion for health

- Ksh 416 billion for security and defense

- Ksh 124 billion for affordable housing programs

- Ksh 395 billion for infrastructure (roads, energy, and transport)

The government is keen on revitalizing the economy by supporting sectors hit hardest by inflation, high borrowing costs, and climate shocks.

“Our investments in universal healthcare, affordable housing, and SME support are deliberate, because these are the needs Kenyans talk about daily,” CS Mbadi emphasized.

Implementation begins on July 1, 2025, the start of the new financial year. The tax measures outlined in the Finance Bill 2025/26 will follow parliamentary debate and public input. Short-term, citizens will notice more structured investments in school capitation, Social Health Insurance Fund (SHIF) restructuring, road maintenance, and digital tax compliance. In the medium term, job opportunities in construction, agriculture, and ICT are expected to rise.

To finance the Ksh 4.2 trillion plan, the government projects Ksh 3.4 trillion in revenue, with Ksh 2.9 trillion coming from ordinary taxes. This includes:

- Value Added Tax (VAT): boosted by crackdowns on fraud and improved collections

- Income Tax: to remain progressive, with proposed bracket adjustments

- Excise Duty: applied on luxury goods, digital services, and certain imports

Additionally, the Kenya Revenue Authority (KRA) will receive Ksh 600 million to upgrade its tax systems with AI and data analytics, to improve efficiency and reduce leakages.

“We are moving from manual to intelligent systems, less bureaucracy, more compliance,” noted CS Mbadi.

Unlike previous budgets focused on macroeconomic balancing, this year’s statement is notably grounded in citizen realities. Whether it is SHIF reforms, the school feeding program, or plans for boda boda insurance coverage, the emphasis is on practical solutions for ordinary Kenyans.

CS Mbadi repeatedly addressed misinformation, saying that “the Finance Bill is not a punishment. It’s our national conversation about how we raise and spend money.” He clarified that digital creators, small business owners, and young professionals were not being targeted unfairly: the intent is to widen the tax base fairly, not penalize effort or innovation.

Public participation remains open. Kenyans are encouraged to submit views to Parliament, attend county budget hearings, and engage with the Finance Bill 2025/26 through https://t.co/1bfiESaNix. CS Mbadi concluded his address with a reminder:

“Development is a collective journey. Let’s work together to fix loopholes, boost our productivity, and leave a better country for the next generation.”

Kenya’s 2025/26 budget marks a shift, less about austerity, and more about Kenyans. It’s a chance to build trust in the government’s ability to deliver services, protect jobs, and prepare for future shocks. With transparent plans and inclusive reforms, the country is signaling its readiness to reclaim fiscal stability while never losing sight of its citizens.