If you’ve heard politicians arguing about the Finance Bill or seen heated debates on social media, it is a reminder that public participation is calling. For good or bad reasons, the Finance Bill dominates national discourse every June. It's more than just paperwork, it is the document that dictates what goods will become more expensive, and how much tax the Mwananchi will pay.

Kenya's annual attempt to balance ambition and resources is through the Finance Bill 2025. This is how a country intends to raise money to pay for everything from roads to education and still keep it running. This year’s bill includes proposals such as:

New tax bracket: Middle-class employees and business owners may be impacted by new tax brackets that target various income levels.

VAT changes: Depending on what is taxed or exempt, the price of necessities may increase or decrease due to changes in VAT on luxury and essential goods.

Green taxes: Green taxes are a fancy way of saying that polluters, particularly those who import or produce plastics, may have to pay more.

Digital taxation: The goal of digital taxation is to collect money from the rapidly expanding online economy, which includes influencers, independent contractors, and app-based services.

The bill attempts to strike a balance between guaranteeing equity and expanding the tax base. However, not every proposal will pass Parliament, some will be changed or dropped entirely in response to public feedback.

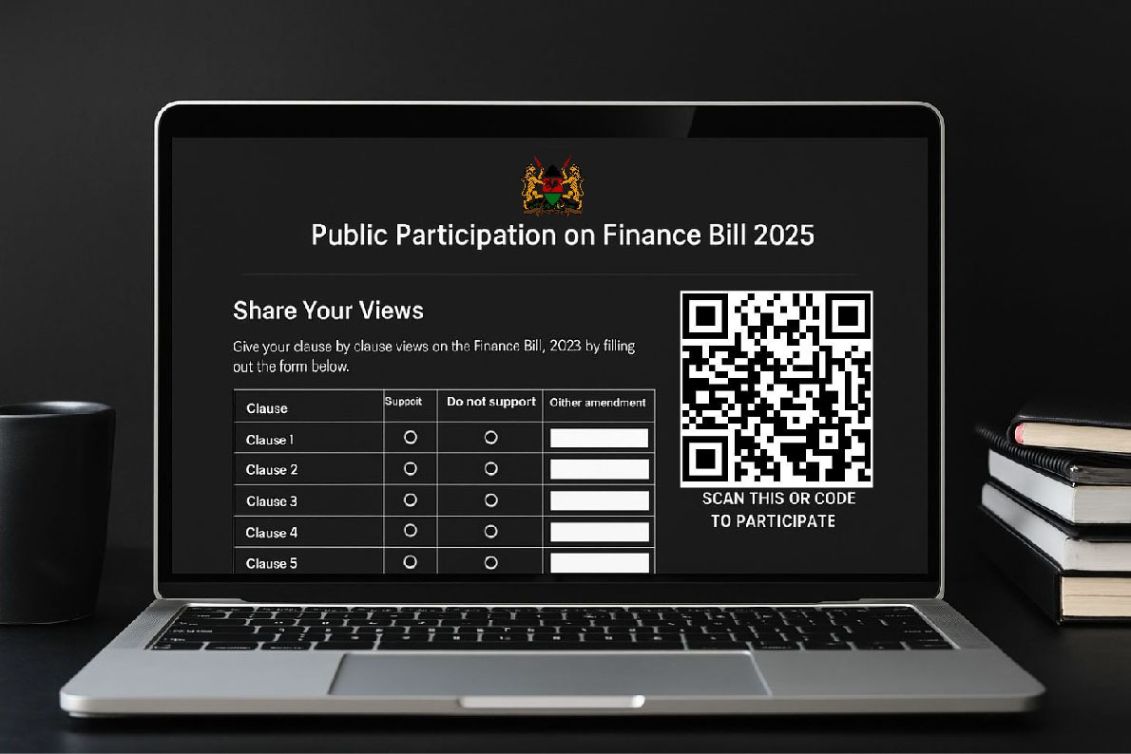

This is why it's important to comprehend the bill. Whether you're a boda boda or a mama mboga, a business owner, student, this bill affects your day-to-day existence. Therefore, don't rely solely on the headlines to tell you the truth. Explore the specifics, pose inquiries, and attend public participation in your county.