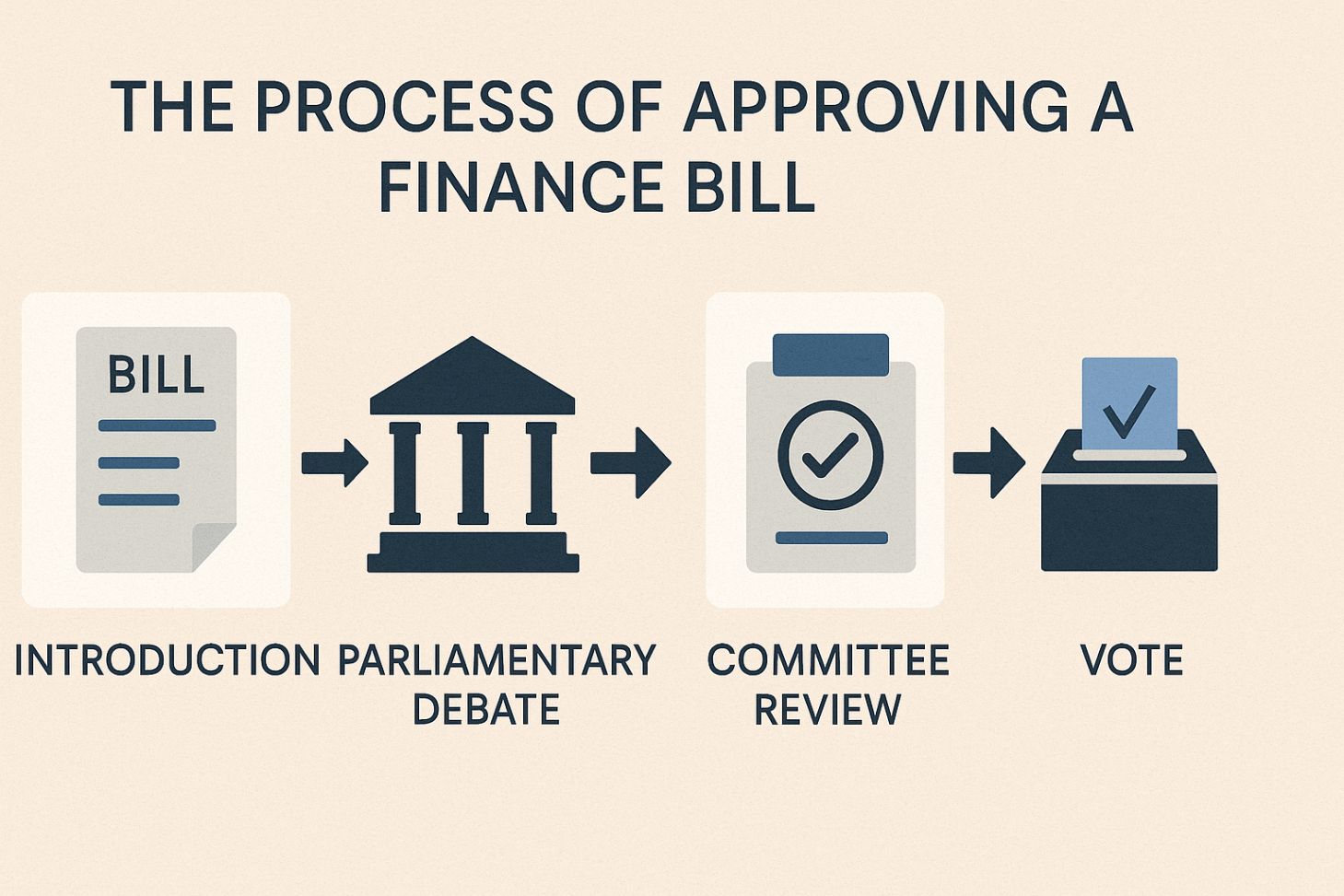

The Finance Bill 2025/2026 is already underway and it will take some processes, and meaningful discussions, before it is approved and becomes law. From drafting to public comment to final assent, every step is intended to guarantee that tax laws are inclusive, equitable, and transparent. The government may not have the legal right to levy additional taxes if the bill is postponed or rejected by the people.

This is a condensed, step-by-step explanation of how the Finance Bill is passed into law in Kenya, complete with actual dates, citations to relevant laws, and updates on the 2025/2026 version.

Step 1: Drafting and Cabinet Approval

The Finance Bill is drafted by the National Treasury to begin the process. Proposed modifications to taxes, levies, and duties are included in this draft. When finished, it is sent to the Cabinet for approval. The Public Finance Management Act's legal deadline of April 30, 2025, was met for the 2025/2026 finance bill.

Step 2: Tabling in Parliament (First Reading)

Following Cabinet approval, the bill is sent to the National Assembly, which formally reads the title aloud during the First Reading. There's no argument now. On May 6, 2025, the Bill was published and made available to the public and Members of Parliament after being tabled in Parliament.

Step 3: Committee Review and Public Participation

The Departmental Committee on Finance and National Planning is in charge of the Finance Bill. Public participation is required by Article 118 of the Constitution. Through hearings and memoranda, the committee gathers public input. To enable this work to continue during its May recess in 2025, Parliament made special arrangements.

Step 4: Second Reading (Debate Begins)

The Finance Bill was given top priority for discussion when Parliament reconvened on May 27, 2025. MPs debate the bill's overall merits during this second reading. Although there are currently no changes, the committee's report and public input are used to discuss important issues.

Step 5: Committee of the Whole House (Clause-by-Clause Amendments)

Following MPs' approval, the bill moves on to the Committee of the Whole House, a more in-depth stage. MPs propose and vote on amendments as they go over the bill clause by clause. This guarantees that contentious or ambiguous suggestions can be modified before the final draft.

Step 6: Third Reading and National Assembly Approval

After that, the amended version of the bill is put to a final vote. The Finance Bill will be formally approved by the National Assembly if it passes this Third Reading. It does not require Senate approval because it is a money bill.

Step 7: Presidential Assent

The Bill is forwarded to the President following its passage by Parliament. The President has 14 days under Article 115 to sign it into law or provide feedback. It becomes the Finance Act 2025 if it is signed, and it must be in effect by June 30 in order for the new tax laws to go into effect on July 1st, 2025.

Knowing this process guarantees that leaders are answerable to the people and encourages citizens to participate positively.